Options strike price calculator

Ad SPX suite of index options offers an array of benefits and product features. This calculator shows potential prices for both calls and puts.

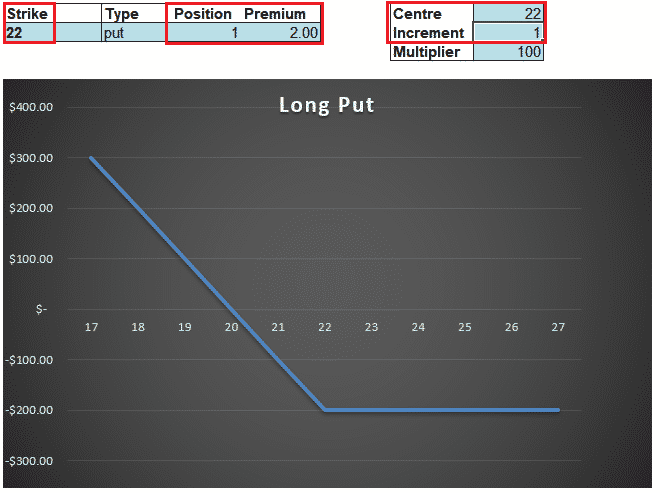

Calculating Call And Put Option Payoff In Excel Macroption

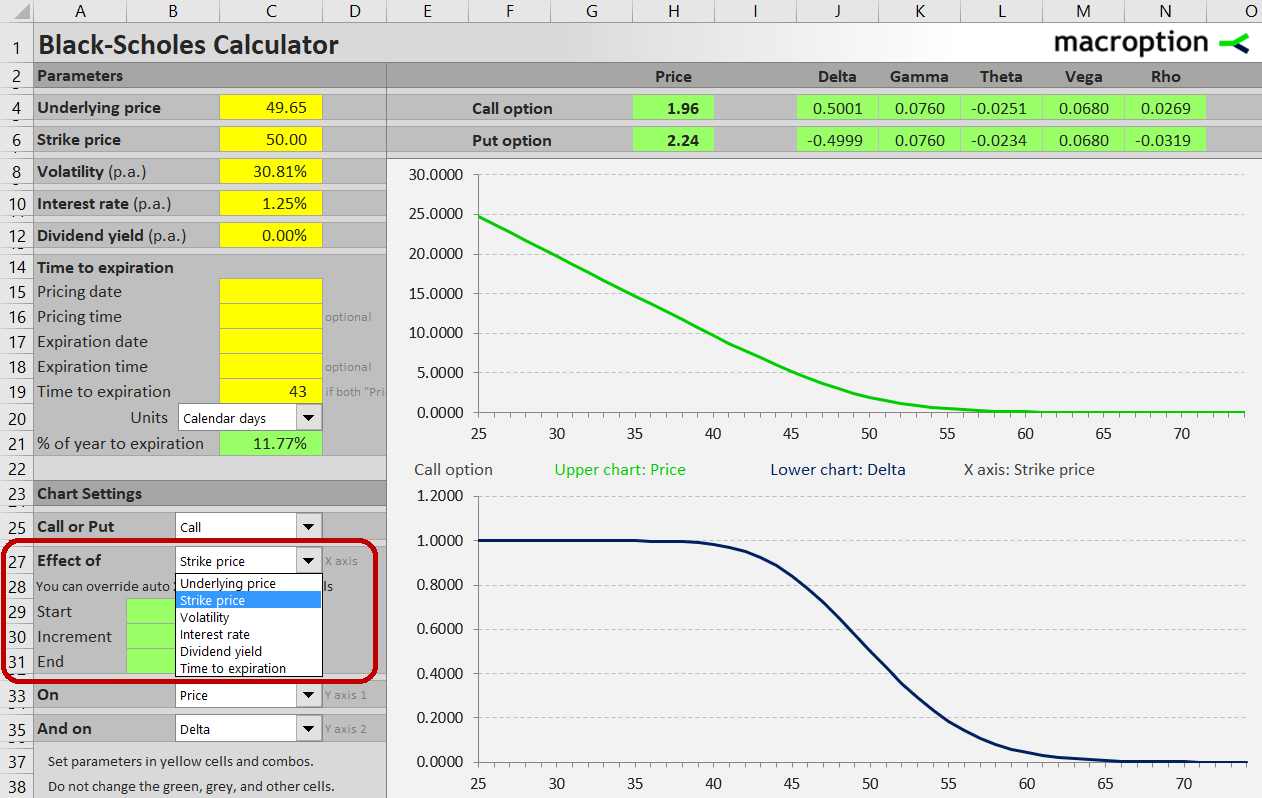

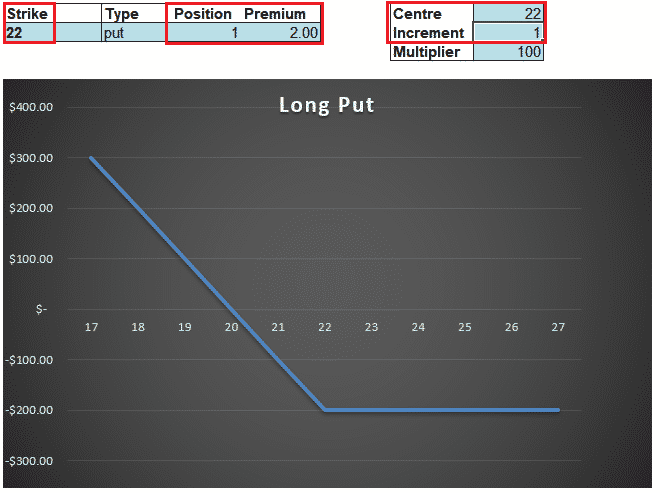

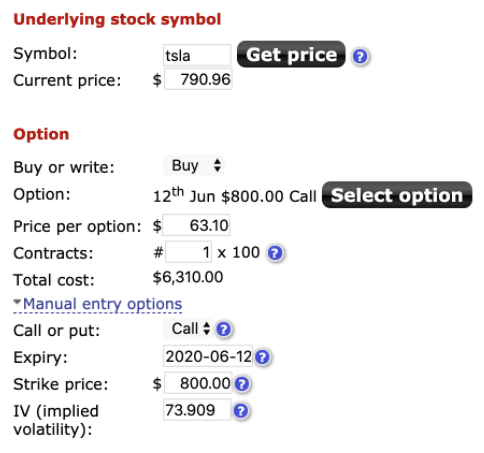

So an option price of 038 would involve an outlay of 038 x 100 38 for one contract.

. For example a 30-day option on stock ABC with a 40 strike. Visit Samcoin today for more information. Add library description here fun this is a library to help calculate options strike price and expiration that.

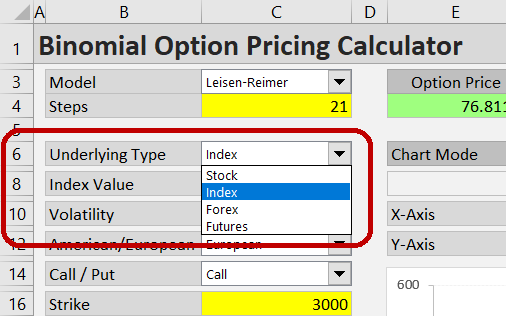

The calculator can model effects of strike price selection on call or put option prices or any of the Greeks. CONT DIV YIELD 0015 for 15. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

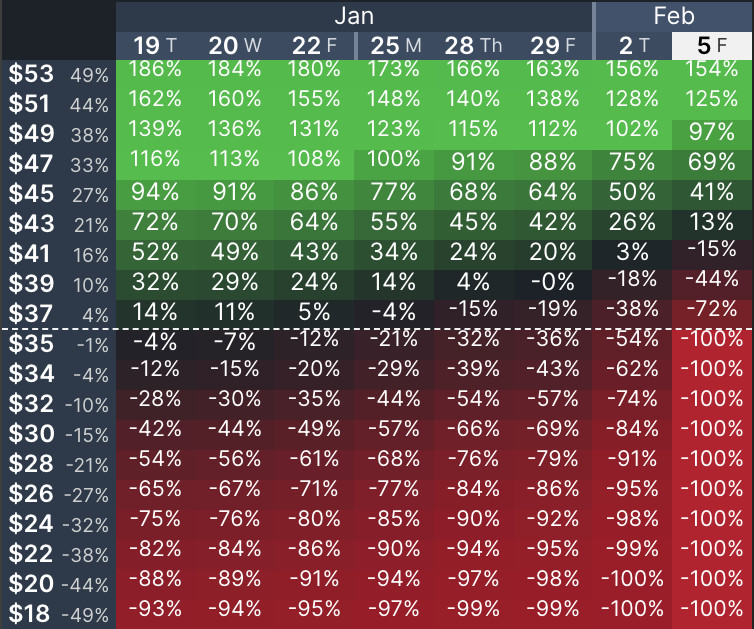

Projected ROI in the Stock Options Calculator is the return on your Bought Option Contract at the Target Stock Price you entered. An option price of 226 requires an expenditure of 226. From big to small find the right size to fit your options trading strategies.

Safe Consistent Income Strategy. Test out various options strategies and discover the contract size that works best for you. So lets do a quick refresher on each before getting into how to price them.

Copies of this document may be obtained from your broker from any. Volatility Risk Free Rate pa. Download Smart Options Strategies free today to see how to safely trade options.

Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. That is an option with a strike price of 150 will have a much. Calculates Prices of Options.

Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator. Options Calculator Calls vs. TIME TO EXPIRATION IN DAYS.

Multiply the strike price by 100 to calculate the additional amount youll pay to use the option to buy or sell stock. Option price is a function of many variables such. For a call option the break.

In-the-Money or ITM option strike prices will always have positive intrinsic value. The Greek is used in the name because these are denoted by Greek letters. Generate fair value prices and Greeks for any of CME Groups options on futures contracts or price up a generic option with our universal calculator.

Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Setting Strike Price Charts. Option Greeks are option sensitivity measures.

Concluding the example multiply 35 by 100 to get 3500. Find the best spreads and short options Our Option Finder tool. Stock Symbol - The stock symbol that you purchased your.

The option premium in general terms for a call option will be lower the farther the strike price is above the underlying price. The main takeaway here is that the deeper IN the Money and Option strike price is the more expensive the corresponding contract will be. Use Options Calculator to calculate options prices with more accuracy.

This calculator to determine the value of an option. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options. Poor Mans Covered Call calculator addedPMCC Calculator.

Library options_expiration_and_strike_price_calculator TODO. Ad 1 Online Trading Education. This means that for the same.

To display a strike price chart select Strike price in. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options. Cash Secured Put calculator addedCSP Calculator.

INTEREST RATE 01 for 10. The strike price is a threshold to determine the intrinsic value of options. This does not account for the Time premium of the options.

A strike price is the price at which a specific derivative contract can be exercised. Black-Scholes Option Price and Option Greeks. On Divident Paying Stocks.

The term is mostly used to describe stock and index options in which strike.

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Option Price Calculator Calculate Bs Option Price Greeks

Ivolatility Com Basic And Advanced Options Calculator

Call Option Calculator Put Option

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Working With Strike Price In The Black Scholes Calculator Macroption

Option Premium Calculation Simplified Try This Shortcut Trick To Find Delta Eqsis Youtube

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Put Option Calculator Easy To Use Excel Tool

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Using Optionstrat S Options Profit Calculator Optionstrat

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Index Options Binomial Option Pricing Calculator Macroption

Options Profit Calculator Updating An Estimate For An Existing Calculation On Options Profit Calculator

Short Selling Put Options

Probability Of A Successful Option Trade